Protecting Account Holders Data Security at Credit Unions and Community Banks

The 2021 Banking Priorities Executive Report survey conducted by enterprise financial technology provider CSI concluded that cybersecurity is the number one priority for financial service providers to contend with this year, and 80% expect some sort of social engineering attack to create the most significant cybersecurity threat of the year. To counter the rise of cybercrime and implement practices to enhance cyber resilience, consider adopting the following perspectives related to organizational culture and data security:- Information security does not start and end with IT professionals but should be your entire organization's cross-functional focus.According to the IBM Cyber Security Intelligence Index, 95% of all cyberattacks happen due to simple and avoidable human errors. Though cybercriminals are always looking to exploit services that offer the most significant risk to reward quotients, you must make cybersecurity training available to key decision-makers across the business divisions responsible for creating and managing new fintech products services.

- You need to confirm the cyber resilience of all partners connected to your success. It is not enough to boost the cyber resilience of your community bank or credit union. It would be best to also think of all the partnerships and third-party vendors connected to your success. We encourage you to request an up-to-date SOC Type 2 Report for all your partnerships but especially those connected to rolling out new fintech products and services.

- Take the time to review all file-sharing protocols across your business divisions. Multi-factor authentication practices are the absolute best way to protect your organization from being embroiled in a costly data breach event. Review file sharing protocols and ensure that proper authentication practices are being followed by all internal employees and external vendors connected to the development and management of your fintech solutions.

- Create institutional data integrity policies. Criminals are always looking to exploit weak links in your value chain. Avoid that by initiating company-wide data integrity policies ensuring all data is being handled in the most up to the date ways. Do not allow your organization to become victimized due to human errors that can be easily trained against and avoided.

- Focus on completing firmware updates and system patches over offering new releases. Community banks need to focus attention on updating their fintech platforms regularly. Focus attention on completing firmware updates and system patches rather than relying on constantly offering new releases. Many recent data breaches have involved old systems that were meant to be phased out. Avoid this by constantly seeking to improve security, even if that means updating old systems.

The New Normal: Global Cybercrime Targeting Financial Technology on the Rise

Coinbase and Square's Cash App are two recent examples of disruptive fintech solutions— that many community banks and credit banks would like to roll out competing services to counter—that have fallen victim to high-profile data breaches in recent weeks. Now, as tempting as it might be for community banks and credit unions to avoid rolling out new and potentially insecure financial technology apps and platforms, there is not much evidence to suggest that can happen. Instead, it seems much more likely that despite the mounting data that suggests fintech is highly vulnerable to outside threats, community banks continue experimenting with new solutions to engage customers and keep them from switching to neobanks and niche-fintech solutions to fulfill their ongoing personal and commercial banking needs. The new normal of business in 2021 is one in which companies around the world grapple with the complexities of digital transformation initiatives and new organizational culture trends that are favoring remote hybrid work arrangements. Under this new culture, community banks have renewed pressure to roll out new technologies to maintain competitive advantage while staying ahead of emergent trends. This pressure has created a perfect storm of opportunity for enterprising criminals, and it takes enhanced cybersecurity approaches to counter it. Fintech solutions offer community banks and credit unions unique benefits that should not be overlooked even amidst a more challenging cyber threat environment:- Enhanced Operational Efficiency and Ability to Scale Popular Products and Services: Financial technology products and services are becoming extremely popular with consumers and business customers. While security fears are real, most consumers are more interested in boosting efficiency, speed, and utility.

- Ability to Target a Younger Demographic: Community banks and credit unions tend to be most prevalent in communities dominated by aging baby boomers' spending behaviors. That is changing, and fintech solutions offer the ability to engage younger audiences and keep them from switching to larger banks, neobanks, and niche-fintech platforms.

- Increased Opportunities to Offer Loans to New Customers: Consumer, mortgage, and commercial loan services can scale with digital offerings rolled out across websites and through dedicated apps. These new business models vastly reduce the overhead cost of loans to increase top-line performance and bottom-line profitability.

- Improved Brand Reputation: By offering more modern and streamlined digital services, community banks have the opportunity to attract and secure more lucrative bases of customers. Furthermore, by giving customers the services they want, there are fewer reasons for them to switch service providers.

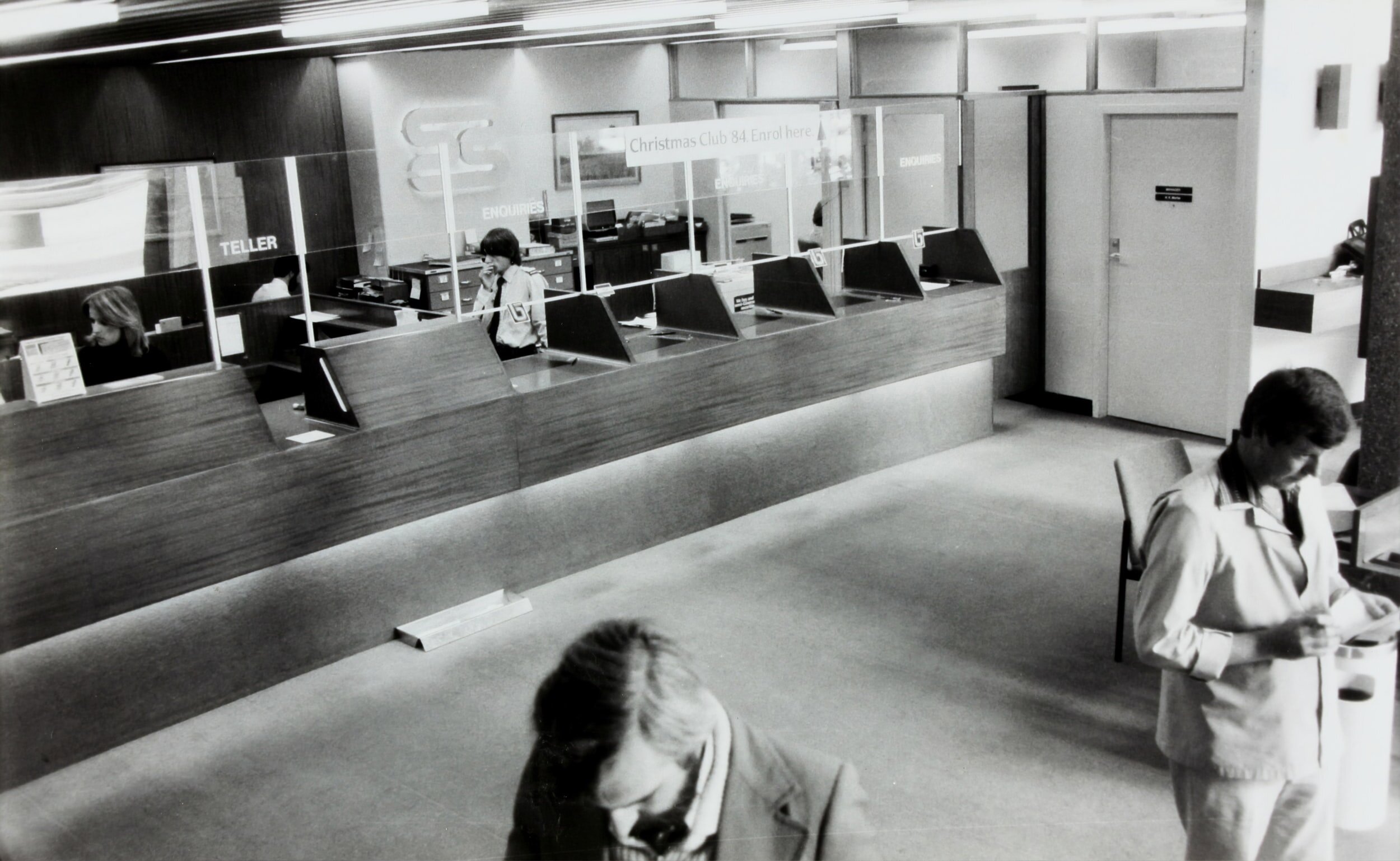

- Deliver a More Robust Customer Experience: Community banks struggle to balance serving local communities and reducing costs. Many chose to close retail locations and reduce contact with local communities. Fintech solutions offer a unique opportunity to offer customers a more individualized experience that benefits both the bank and the customer.